|

|

| Only the most seasoned of investors have heard of Nicolas Darvas and his best-selling book and investment strategy that made him millions in the stock market in the 1950's. His life story, from Hungarian national to United States dance star to millionaire investor sounds extraordinary, but it actually happened. That kind of trading success is something most investors can only dream about.

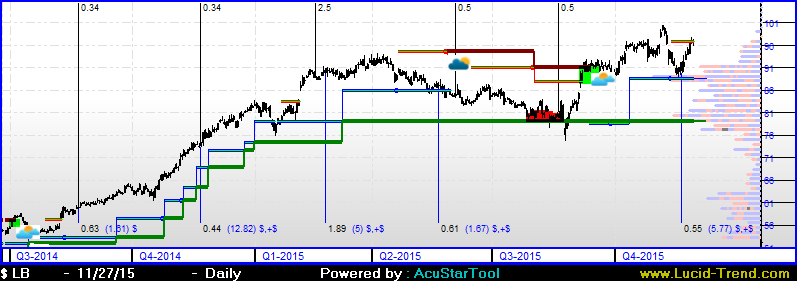

Using Barron's weekly newspaper for research, he developed his own investing technique. Communicating via telegram with his broker, he bought and sold stocks in his spare time, eventually turning a $36,000 investment into more than $2.25 million in just three years. Darvas would take his extraordinary investing strategy and turn it into a best selling book, "How I Made 2,000,000 in the Stock Market," which was published in 1960. What Is The Darvas Box Theory & Strategy? The Darvas Box Theory as a trading strategy is deceptively simple, as it involves only buying into stocks trading at new 52-week highs. His goal was to build a trading system that allowed him to ride a powerful stock's rising trend for as long as it remained on the rise. Trading via his method requires a lot of discipline, but can produce big profits when strong trends develop. The strategy itself uses a combination of technical and classic trading strategies to create a simple trend recognition system. A signal is generated when the price of a stock rises above the previous 52-week high and then falls back to a price just below the new (higher) price. If the price falls too much, it can be a signal of a false breakout. If it does not, then the lower price is used as the bottom of the box and the high as the top. A "Darvas Box" identifies that sweet area between the new high and the new low to indicate an area of consolidation. This is why Darvas attempted to only trade stocks when volume and earnings were on the rise. Investopedia has a great article on the history of Nicolas Darvas and his Darvas Box Theory for those who would like to learn more. Surprisingly, The Darvas methodology remains almost unchanged since the 1950s, and only one modern update affects the original technique. Now instead of hand-drawing high and low price horizontal lines to form the box, computer software can create it for you. You can also check stock prices daily on the Internet, whereas Darvas had to wait for his weekly newspaper. The miracle of modern technologies! Five simple steps to trading using the Darvas methodology Let me summarize the book for you (although I highly recommend giving it a read.) Here are the basic steps to successfully trading using the Darvas methodology: 1. Find a stock. If the fundamental analysis of the stock is promising and this reflects in the stock price, keep watching. 2. Wait for the stock to make a new all-time high; either an all time high or 52-week high. 3. Purchase the stock as the price trades through its all-time price level. Risk only 1% or 2% of your capital on any stock according to your risk appetite. 4. As the stock is trading up through its previous high, the volume surges. Define your stop loss time frame by checking in your lucid-trend portal. 5. Ride the trade as long as the stock is making new highs. It would be remiss if I didn't mention here that there are Darvas strategy skeptics. Market analysts who have studied his theory attribute part of his success to the fact that he was trading in a very bullish market in the 1950's and 60's. It has also been stated that the same type of results can be achieved by inverting the technique in a bear market, but in a sideways market it is believed that this technique is unlikely to be successful. What I took away from Darvas' Book Only trade stocks with improved earnings potential (or ones that you anticipate will improve after much careful research.) Only trade stocks on major exchanges with adequate volume. Darvas made his millions by selecting stocks in new and growing industries. In the 1950's these were electronics, missiles, and rocket fuels. Think about what excites consumers and investors today. Don't listen to rumors or tips, no matter how well researched they may sound. If the rumors are true, it will reflect in your price chart! Stocks "break out" from inside the consolidation box with higher volumes, therefore look for stocks with unusually high volume activity. Learn to hold one position longer, as opposed to juggling a bunch of positions for a shorter period of time. And perhaps the biggest lesson I took away from the book, you only need to spend few hours a week in order to be successful at investing. We here at Lucid Trend can help you get there! Darvas himself was an amateur investor and self-made man. Invest in yourself and your own knowledge rather than listening to cheering crowds of social media. Keep checking out our blogs to learn more about Lucid-Trend and our trend following method. |

Written by: Raj Patel

|

Home Of Trend Following |

|